Schedule C is an important tax form for sole proprietors and other self-employed business owners. It’s used to report profit or loss and to include this information in the owner’s personal tax returns for the year

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

⦁ The process for completing Schedule C begins with gathering information.

⦁ This process will give you a net income or loss amount for your business. Add this amount to your personal tax return, along with other income you received during the year.

⦁ You will also need to calculate self-employment tax payable (Social Security and Medicare for small business owners) if you had income (not a loss) for the year. Add the self-employment tax liability to your tax return.

Step 1: Collecting the Info of expenses

⦁ Business income: Need detailed information about the sources of your business income. Including returns and allowances.

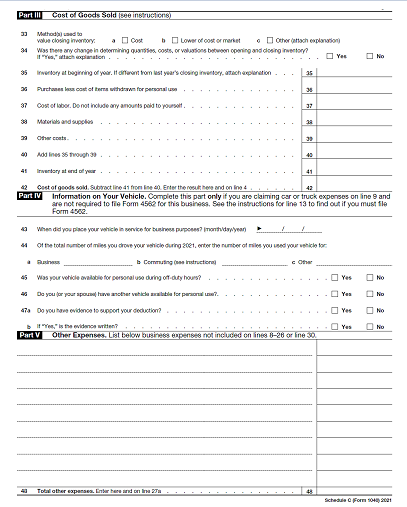

Cost of goods sold: If you have an inventory of products for sale.

⦁ Beginning Inventory value for the year.

⦁ Ending inventory value for the year.

⦁ Cost of labor, materials, and supplies.

Business expenses: Gather all the expenses related to the business or used for business.

⦁ Phone, utilities, computer expenses, and other office expenses

⦁ Business insurance, like insurance on your business property, and disability insurance.

⦁ Supplies, including office supplies.

⦁ Wages you paid and payments made to non-employees.

⦁ Interest on loans, leases, mortgages, and other business debts.

Meals will be deductible at 50% and Entertainment is non-deductible.

⦁ Some expenses are difficult to categorize on a tax return. That can be mention in miscellaneous expenses like petty cash and etc.

Step 2: Calculating the Gross Profit and Income

⦁ Gross receipts from sales – Returns and allowances = Net receipts

⦁ Net receipts – Cost of goods sold = Gross Profit

⦁ Gross Profit + Other income from tax credits or other sources = Gross income

Step 3: Include Your Business Expenses

Business expenses that you can deduct are listed.

⦁ You can deduct depreciation, and Section 179 expenses, as well as employee benefits and insurance, including property insurance but not health insurance.

Interest on mortgages and other business debts is deductible, as are : legal and professional fees, office expenses, and pension and profit-sharing plans.

⦁ You can also deduct rental or lease costs of vehicles or other business equipment, repair and maintenance, ⦁ supplies, taxes and licenses, ⦁ travel expenses, ⦁ meals and entertainment, utilities, and wages.

⦁ Bank fees, uniforms, and clothing, advertising, Marketing, internet and website charges, books, magazines, and software, phone, and cell phone costs.

⦁ Wages, salaries, and payroll tax expenses are deductible costs. The total wages paid, the employer portion of FICA taxes (Social Security and Medicare), unemployment insurance, and federal and state workers’ compensation insurance and other miscellaneous expenses are all deductible expenses.

Step 4: Include Other Expenses and Information

Business use of your home

⦁ Completing the Form 8829, by calculating the total area of your home and getting a percentage for your home business. Include the total allowable expenses resulting from those calculations on Schedule C.

Vehicle expenses used for Business

⦁ Need to include information in Form 2106 about the business driving mileage, commuting mileage, and total driving mileage.

Step 5: Calculating Net Income

The final calculation for net income

⦁ Enter total expenses (Line 28) and subtract this amount with Gross Income (Line 7) to get your tentative profit (Line 29).

⦁ Then subtract the expenses for the business use of your home (Line 30) to get your net profit or loss (Line 31)

And If You Have a Business Loss

If your Schedule C shows that you have had a business loss (expenses are greater than income), you must show whether your loss is at risk or not, on Lines 32a and 32b (Most small business owners have full risk if they participate fully in the business). You may have to file Form 461 Limitation on Business Losses if you have a business loss. {File Form 461 for non-corporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a joint return)}

Adding Schedule C business Profit/ Loss to 1040 Tax Return

Carry the net profit/loss from the line 31 of Sch C to Sch 1, line 12 of Form 1040. Add or subtract income or loss from the business to other income or losses from other business.

Self-Employment Tax on Sch C

The total net profit on line 31 of Schedule C is also used to calculate self-employment taxes to be paid by the owner of the business. If the business has a loss, no self-employment tax is owed. The self-employment tax is calculated on Schedule SE.

SCH C FLOW

⦁ Schedule C

⦁ Schedule 1

⦁ Form 1040