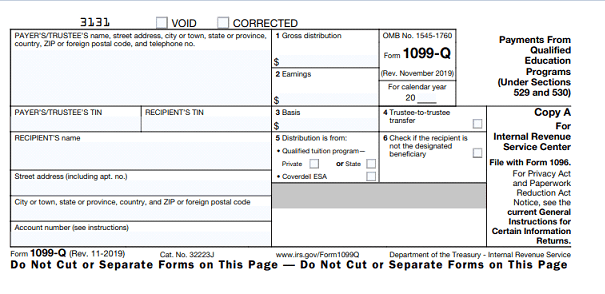

FORM 1099-Q-PAYMENT OF QUALIFIED EDUCATION PROGRAMS (Under Sections 529 and 530)

Introduction:

The Form 1099-Q it shows the distribution amount from qualified education programs. If you’re paying for school expenses you will likely to receive an IRS Form 1099-Q which reports the total withdrawal you made during the year. If you contribute the money to qualified education plan like 529 plans or a Covered II ESA you can claim. If you need add new beneficiary to existing plan, the member of new beneficiary must designated to family of contributor and under the age of 30. The family includes Spouse children’s stepchildren’s foster children, and their descendants.

The Form 1099-Q will report the total withdrawal of during the year and some of these amounts will taxable depending upon the plan which you choose. The plans have some key differences in what educational expenses they cover but their tax treatment is essentially the same, you invest money on behalf of a student the investment profits are tax-free and distributions that go to pay qualifying educational expenses are not subject to income tax.

The Form 1099-Q containing six boxes,

⦁ First box reports annual distribution or withdrawal from the account.

⦁ Second box reports the income or earnings of your Investments and

⦁ Third box reports the basis of distribution.

⦁ Forth column represented the transfer between the two qualified tuition Plans,

⦁ Fifth column need to check the box Private or state ESA and

⦁ Sixth column represented to designated beneficiary whether recipient covered under QTP or ESA.

⦁ And Also need to entered Payers name and address includes Zip code telephone and Payer TIN and Recipients TIN recipient name address and account number.

When 1099-Q contributions become a taxable?

If the distribution doesn’t exceed the amount of the student’s qualifying expenses, then you don’t have to report any of the distribution as income on your tax return. If the distribution exceeds these expenses, then you must report the earnings on the excess as “other income” on your tax return. When you pay a student’s school expenses with these funds, you cannot claim a tuition deduction or either of the educational tax credits for the same expense.

Who can claim the Form 1099-Q:

⦁ Anyone who has made a distribution from a plan 529 or ESA.

⦁ Employees who have control of a program established by a state or qualified educational institution.